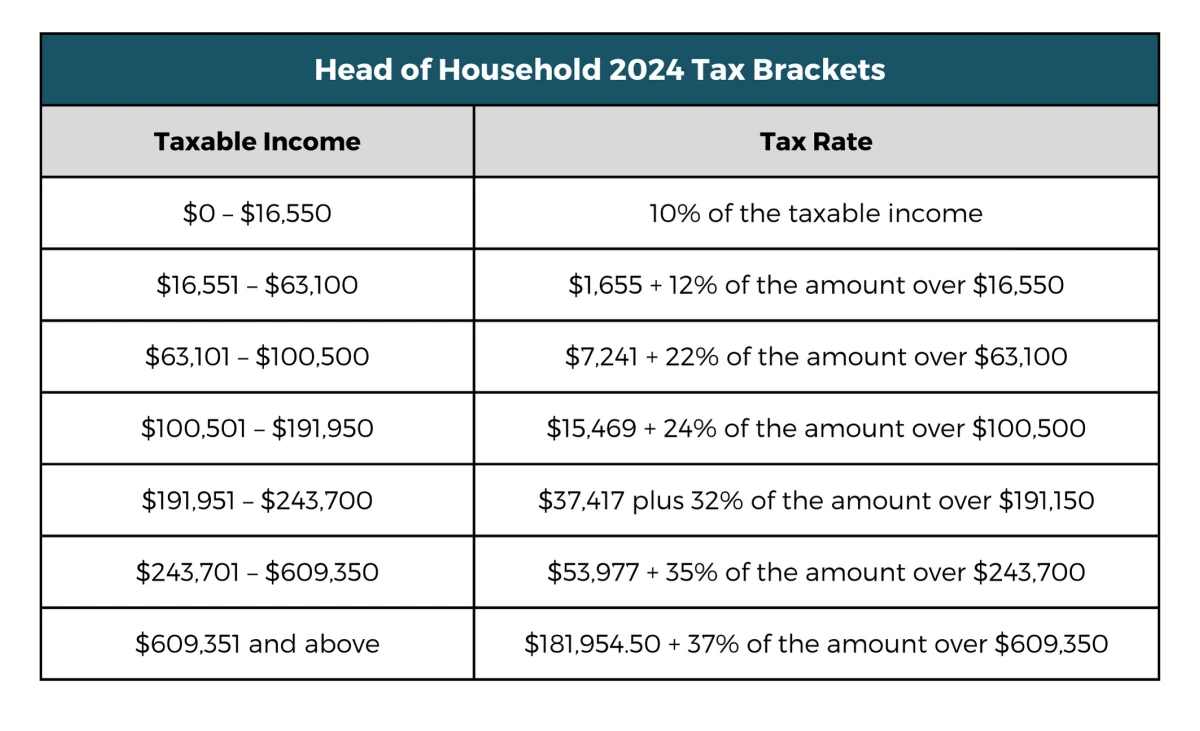

2025 Tax Brackets Head Of Household. Find out the federal income tax rates and brackets for head of household filing status in 2025. See the 2025 tax rates (for money you earn in 2025).

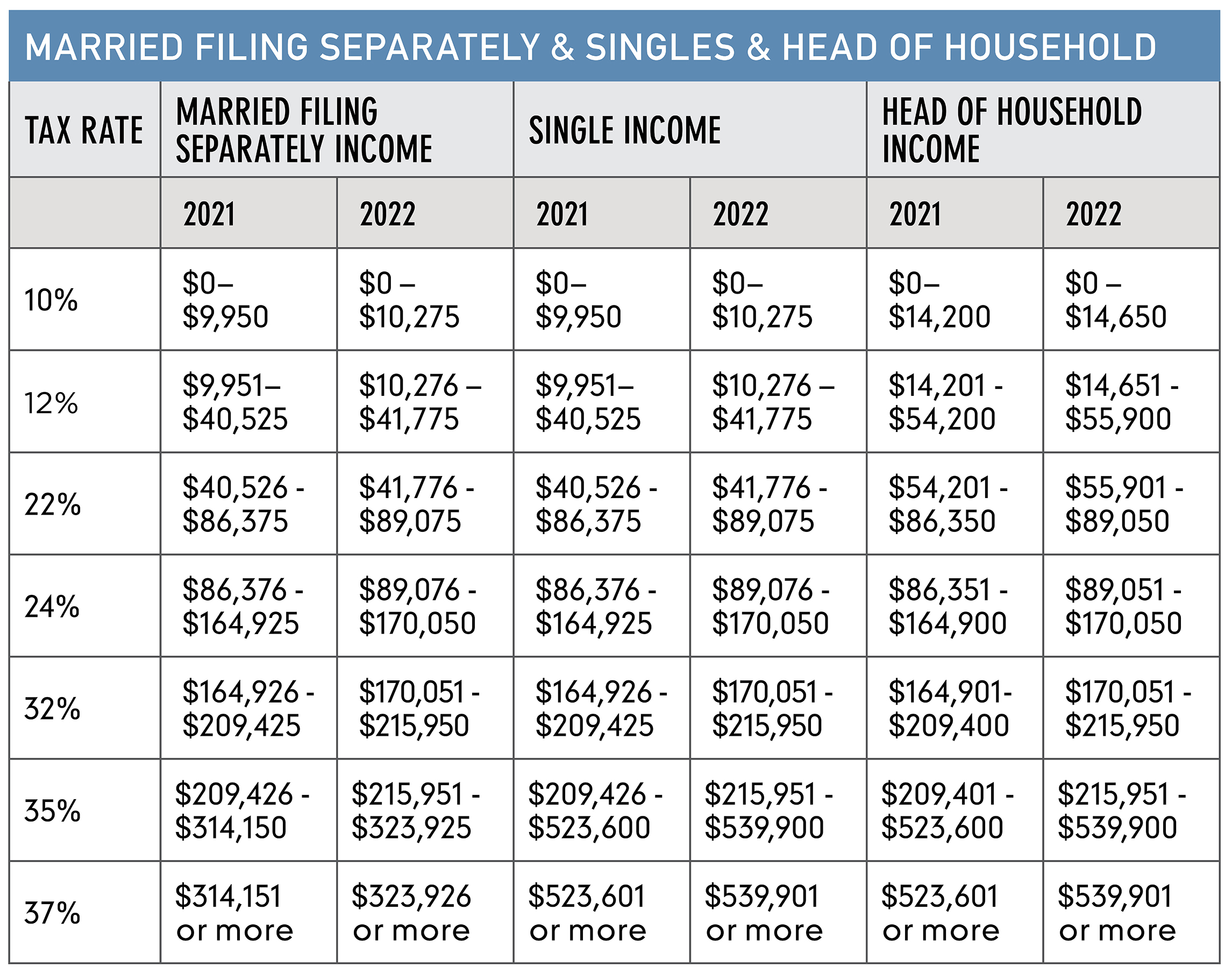

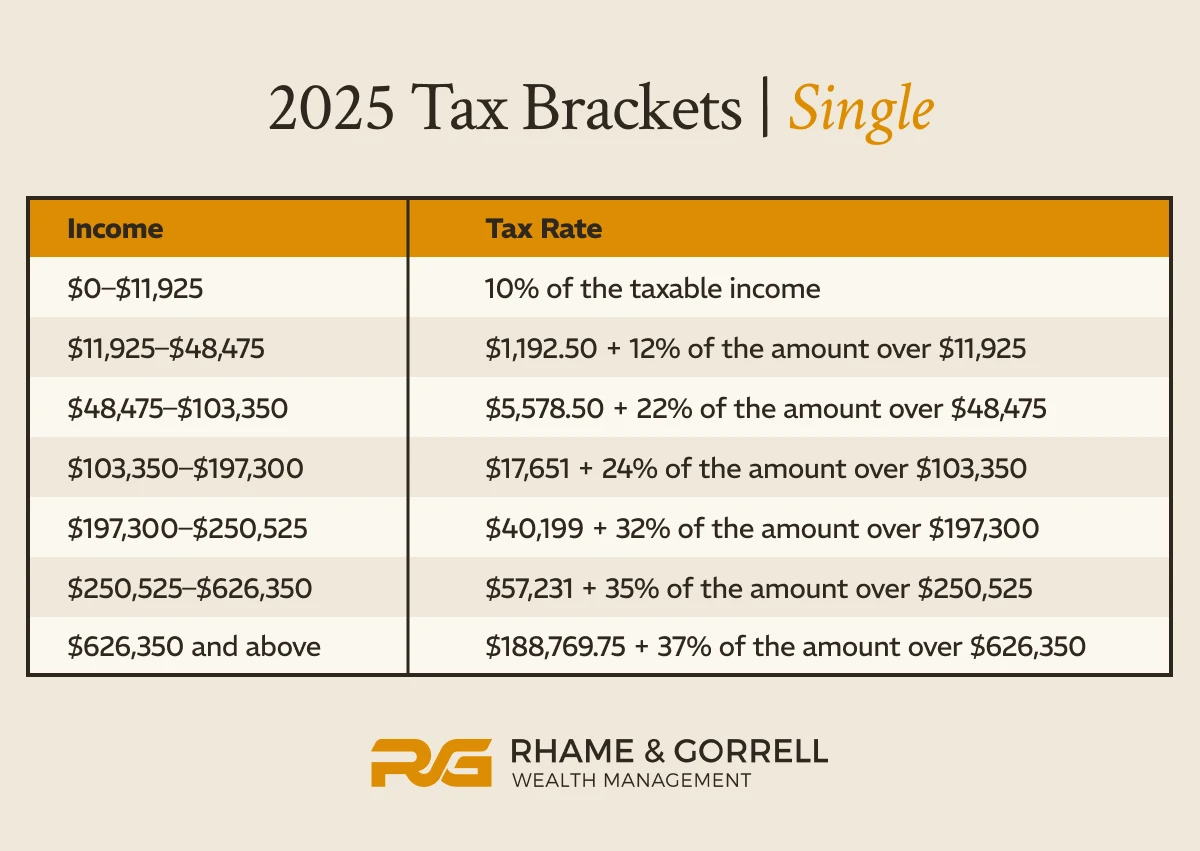

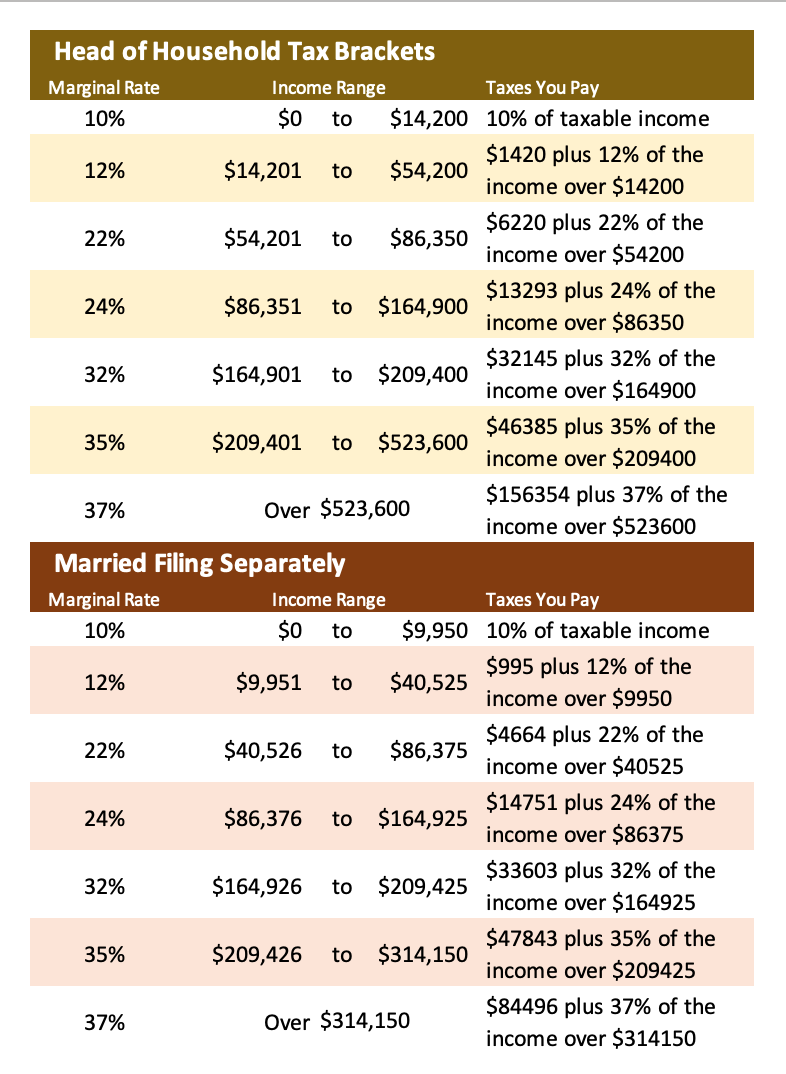

In this article, we’ll break down how to determine the tax. 2024 & 2025 tax brackets (irs federal income tax rate tables) for single, married filing jointly & separately, & head of household. Find out the income thresholds and tax rates for head of household filing status in 2025.

Find The Current And Projected Tax Rates And Brackets For Different Filing Statuses, Including Head Of Household.

In this article, we’ll break down how to determine the tax. Wondering about 2025 tax brackets and how they’ll affect your tax? Find out the federal income tax brackets and rates for heads of household in 2025, adjusted for inflation by the irs.

Find Out The Income Thresholds And Tax Rates For Head Of Household Filing Status In 2025.

The 2025 standard deduction is increased to $30,000 for married individuals filing a joint return; 2024 & 2025 tax brackets (irs federal income tax rate tables) for single, married filing jointly & separately, & head of household. Find out the federal income tax rates and brackets for head of household filing status in 2025.

See The 2025 Tax Rates (For Money You Earn In 2025).

The standard deduction for heads of households for tax year 2025 is $22,500, an increase of $600 from 2024. The irs adjusts over 60 tax provisions for inflation using the chained consumer price index. Compare with 2024 and 2023 tax.